Inflation has global markets reeling. Could cryptocurrencies offer some stability?

Inflation. It's the buzzword of this season of US economics, finance, and regulatory politics. It refers to a reduction in the purchasing power of a currency––in this case, of the US dollar––where, as the prices of goods and services increase, each dollar can buy less of them.

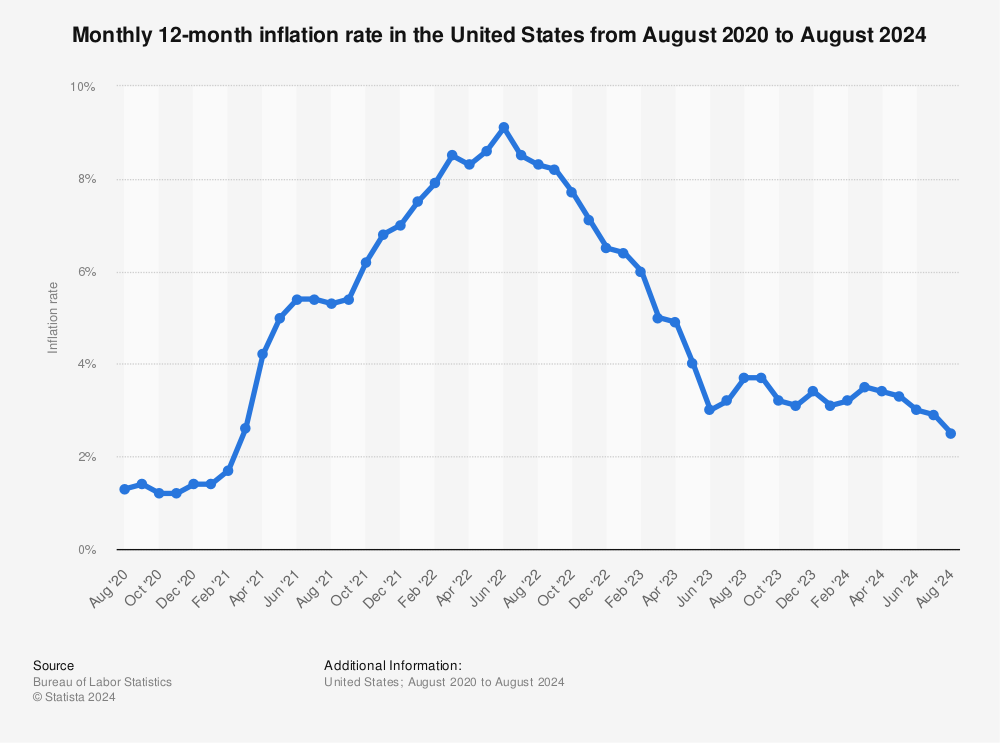

It can be felt in every tier of the economy––on Wall Street's trading floor, at the international cargo ship docks, currency exchanges, and at the local gas station. Especially after setting a record-high of 9.1% in June of 2022, inflation has comfortably plopped itself down atop the collective American mind.

We are all interested in protecting our wealth. As inflation poses a very real and ever-increasing threat to the wealth represented by each dollar, we will begin to see adaptive financial behaviors deployed in support of wealth protection. What role might some cryptocurrencies have to play in an inflationary landscape?

Inflation in the United States

Though it may appear to the average American that inflation has only recently become a concern, it has always been a financial reality, albeit in "trace" amounts. From 2012 to 2020, US inflation ranged somewhere between 0.7% to 2.3%.

So, how did we get to 7% in 2021 and 8.3% YTD in 2022?

It has to do with the US money policy, which is established by the Federal Reserve. On Sep. 21, Jerome Powell, Chairman of the Federal Reserve's Board of Governors, addressed the media from Washington, DC about the state of US inflation, which sits at 8.3%.

Americans are beginning to feel the discomfort of rising prices, and are no doubt seeking to protect their financial portfolios and maintain their living standard. Though the current situation surrounding inflation is alarming, it hasn't yet reached a boiling point. Not in the US, at least.

Worldwide inflation

The US has historically experienced low, stable levels of inflation. Not so in other countries.

A quick search of Worldwide Trading's data reveals the ten countries currently experiencing the highest inflation are:

- Zimbabwe: 280%

- Lebanon: 162%

- Syria: 139%

- Sudan: 125%

- Venezuela: 114%

- Turkey: 80.21

- Argentina: 78.5%

- Sri Lanka: 64.3%

- Iran: 52.2%

- Suriname: 49.2%

That list makes the US' rate of 8.3% feel tame.

Here's a list of the top ten countries with the most dramatic inflation hikes over the past two years, per the Pew Research Center:

- Israel: 25x

- Greece: 21x

- Italy: 19x

- Spain: 13x

- Portugal: 11x

- Estonia: 8x

- Denmark: 7x

- Belgium: 7x

- Finland: 6x

- Ireland: 6x

While the US' 4x inflation hike is causing consumers to re-evaluate their financial behaviors, consumers in other countries are experiencing much more severe pressure. When your savings are rapidly shrinking, and your purchasing power is quickly dwindling, something has to give.

So what are consumers doing in economies with rampant, uncontrolled inflation?

Inflation and crypto

Crypto is a unique instrument because it's decentralized, meaning it isn't overseen by a governing body. And, in most cases, its supply is predetermined and stable. New crypto "coins" are minted on pre-established, known dates, and in predetermined, known amounts.

So, while the crypto landscape remains highly volatile, some cryptocurrencies are virtually immune to inflation. At least in theory.

Gemini, a company that provides crypto products and services, recently released their 2021 study on the Global State of Crypto. Something I found very interesting was that consumers from countries experiencing high levels of inflation (over 50% inflation, relative to the US dollar) indicated that they're three to four times more likely to purchase crypto in the next year than their counterparts from countries experiencing lower inflation.

It would appear that, when consumers are forced to choose between rampant inflation and volatile crypto prices, the latter is perceived to be the lesser of the two potential evils. It would also appear that the tipping point is at or around 50% inflation––that's when consumers turn from money to crypto as a store of value. After all, history suggests that crypto will eventually appreciate. But inflation-ladened economies never magically shift overnight, experiencing an increase in the purchasing power of their currency.

Gemini's study also showed that 79% of crypto owners "say they buy and hold cryptocurrency for its long-term investment potential," proof that crypto is already widely viewed as a viable long-term store of value.

So what's keeping crypto from being able to hedge inflation in the US?

Trust. As long as there is high volatility in the crypto market, US consumers will hesitate to trust crypto over money as a long-term store of value.

But trust in crypto is growing. Gemini's study also revealed that 41% of crypto owners purchased crypto for the first time in 2021. This is an indication that adoption of crypto is increasing by leaps and bounds.

As crypto becomes more commonplace, and more individuals participate in the crypto market, we can expect to see crypto price volatility decrease. With less volatility comes more trust, and thus more stability. When that will happen is yet to be seen, but it's not difficult to envision a near future where cryptocurrencies offer a viable solution to protecting one's wealth from the threat of inflation. Just not yet.

.png)

.jpeg)